Are you tired of your investments just padding the wallets of big corporations?

What if your money could work for you and the planet?

Enter green bonds—an investment opportunity that not only promises financial returns but also contributes to a sustainable future.

In a world grappling with climate change, green bonds are not just a trend but a necessity.

This article delves into why green bonds can help every day, low-risk investors who want to make a positive impact without sacrificing returns.

1. What are Green Bonds?

Green bonds are fixed-income securities issued to finance projects that offer environmental benefits. These projects can include renewable energy, energy efficiency, pollution prevention, and sustainable.

These bonds offer a dual benefit:

- Financial returns and

- A positive environmental impact,

making them a compelling choice for socially responsible investors.

2. How Green Bonds Work

Green bonds operate much like traditional bonds. Investors lend money to issuers in exchange for regular interest payments and the return of the bond’s face value at maturity.

The critical difference is that the funds from green bonds are earmarked for environmentally beneficial projects.

Transparency is a hallmark of green bonds. Issuers must provide detailed reports on how the proceeds are used and the environmental benefits achieved.

This transparency helps build investor confidence and ensures the money is making a real impact.

3. Benefits of Green Bonds

As mentioned before, investing in green bonds offers dual advantages. For investors, these bonds provide a way to support environmental initiatives while earning a return.

For issuers, green bonds enhance their reputation and attract a broader range of investors.

According to a study by the Climate Bonds Initiative, green bonds have helped finance projects that reduce carbon emissions by millions of tons annually!

This substantial environmental benefit is a significant draw for eco-conscious investors.

4. Market Trends and Growth

According to a report from Coherent Market Insights, the green bond market size is valued at US$ 525.72 Bn in 2024 and is expected to reach US$ 1,033.43 billion by 2031, exhibiting a compound annual growth rate (CAGR) of 10.1% from 2024 to 2031.

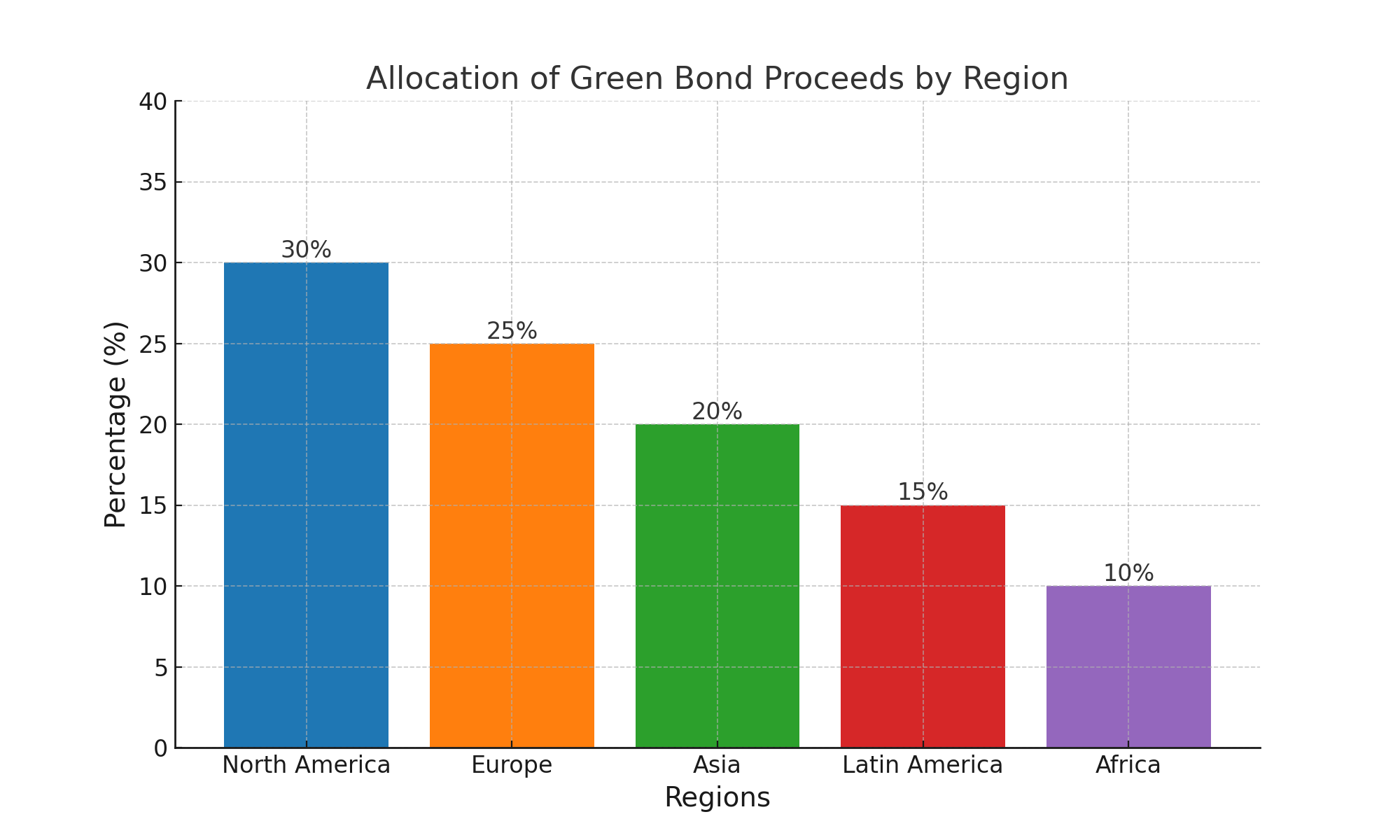

North America dominates the green bond market, accounting for over half of the global issuance, followed by Europe and Asia-Pacific. This regional breakdown highlights the global nature of the push towards sustainable finance.

5. Key Players in the Green Bond Market

Key players in the green bond market include sovereign states, municipalities, corporations, and financial institutions. Notable issuers like the European Investment Bank, World Bank, and Apple Inc. have set benchmarks for transparency and impact.

These organizations not only finance significant projects but also pave the way for others by demonstrating that sustainable investments can be both profitable and impactful.

6. Examples of Green Bonds with CAGR

Investors looking for tangible examples of successful green bonds can look to several noteworthy issues:

- Apple Inc. Green Bonds: Apple has issued several green bonds, raising billions for projects that focus on renewable energy and energy efficiency. These bonds have shown a compound annual growth rate (CAGR) of ~5% over the past year.

- European Investment Bank (EIB) Green Bonds: EIB is one of the largest issuers of green bonds, funding a wide range of sustainable projects. Their green bonds have demonstrated a CAGR of ~4.7% over the past year.

- Republic of France Sovereign Green Bonds: France’s sovereign green bonds finance a variety of environmental initiatives, including renewable energy and climate change adaptation. These bonds have achieved a CAGR of ~4.5% over the past year.

- Indian Railway Finance Corporation (IRFC) Green Bonds: IRFC issued green bonds to fund sustainable rail transport projects, achieving a CAGR of 4.8% over the past year. This initiative supports the development of a low-carbon transportation network in India.

- Yes Bank Green Bonds: Yes Bank was the first Indian bank to issue green bonds, financing projects in renewable energy and energy efficiency. Their green bonds have demonstrated a CAGR of 4.6% over the past year.

These examples highlight the financial viability of green bonds while contributing significantly to environmental sustainability. For more detailed analysis and performance reviews, you can check reputable financial analyst websites such as Morningstar, Bloomberg, and MarketWatch.

7. Challenges and Criticisms

Despite their advantages, green bonds face challenges. One major issue is the risk of “greenwashing,” where issuers may exaggerate the environmental benefits of their projects. Ensuring transparency and accountability is crucial to maintaining investor trust.

Another challenge is the relatively small size of the green bond market compared to the overall bond market. This can limit liquidity and increase transaction costs for investors.

8. Regulatory Frameworks and Standards

Several standards and frameworks ensure the integrity of green bonds. The Green Bond Principles, established by the International Capital Market Association (ICMA), provide guidelines on the issuance process, use of proceeds, and reporting.

Governments and regulatory bodies are also stepping in. For example, the European Union’s Green Bond Standard aims to create a uniform framework for green bond issuance across Europe, boosting market confidence and participation.

9. Future Prospects

The future of green bonds looks promising. As climate change awareness grows, more investors are seeking out sustainable investment opportunities. Innovations like social and sustainability-linked bonds are expanding the market further.

Ongoing development of regulatory frameworks and increasing demand for transparency will likely strengthen the green bond market, making it a key component of sustainable finance.

10. How to Get Started with Green Bonds

Investing in green bonds is accessible to both individual and institutional investors. Many mutual funds and exchange-traded funds (ETFs) now include green bonds in their portfolios, providing an easy entry point.

Before investing, it’s essential to research the issuer, understand the use of proceeds, and consider the bond’s credit rating and environmental impact. Consulting with a financial advisor can also help tailor green bond investments to your specific goals and risk tolerance.

Disclaimer

The content provided in this article is for entertainment and informational purposes only and should not be construed as financial advice. The author is not a financial advisor. Investing in financial instruments, including green bonds, carries risks, and it’s essential to conduct thorough research and consult with a qualified financial advisor before making any investment decisions. Always consider your financial situation and objectives before investing.

Internal Links : The Best Eco-Friendly Products for a Sustainable Lifestyle

FAQs : Green Bonds: Investing in a Sustainable Future

What are green bonds?

Green bonds are fixed-income securities issued to finance projects with environmental benefits. These benefits can include renewable energy projects, energy efficiency upgrades, pollution prevention, and sustainable agriculture initiatives. Unlike traditional bonds, the proceeds from green bonds are specifically earmarked for green projects. This specificity helps investors support environmental sustainability while earning returns. The green bond market has grown significantly, surpassing $1 trillion in issuance, reflecting a strong investor appetite for sustainable investment options.

How do green bonds work?

Green bonds work much like traditional bonds. Investors purchase these bonds and receive regular interest payments over time. At maturity, the principal amount is returned. The critical difference lies in the use of proceeds. Funds raised from green bonds are exclusively used for projects that deliver environmental benefits, such as reducing carbon emissions or enhancing energy efficiency. Issuers of green bonds are required to provide detailed reports on how the proceeds are used and the environmental impact of the projects financed. This transparency is crucial for maintaining investor confidence and ensuring the funds contribute to genuine sustainability efforts.

What are the benefits of investing in green bonds?

Investing in green bonds offers several benefits. Firstly, they allow investors to support environmental initiatives while earning a financial return. This dual benefit appeals to socially responsible investors. Secondly, green bonds can enhance the reputation of issuers by demonstrating their commitment to sustainability. Additionally, green bonds help address climate change by funding projects that reduce greenhouse gas emissions and promote sustainability. For example, a study by the Climate Bonds Initiative found that green bonds have financed projects that cut millions of tons of carbon emissions annually. These benefits make green bonds a compelling choice for eco-conscious investors.

Who are the key players in the green bond market?

The green bond market features a diverse range of issuers, including sovereign states, municipalities, corporations, and financial institutions. Notable examples include the European Investment Bank (EIB), the World Bank, and major corporations like Apple Inc. In India, key players include the Indian Railway Finance Corporation (IRFC) and Yes Bank. EIB is one of the largest issuers, funding a wide array of sustainable projects. The World Bank has also issued substantial green bonds, supporting global environmental initiatives. Corporations like Apple use green bonds to finance renewable energy and energy efficiency projects, setting benchmarks for transparency and impact in the market.

Also read..

Leave a Reply